In response to the G20 calls for suspension of debt payments from the world’s poorest nations for the remainder of the year, the Africa Private Creditor Working Group (AfricaPCWG) was set up to coordinate the views of over 25 asset managers and financial institutions representing total assets under management in excess of US$9 trillion.

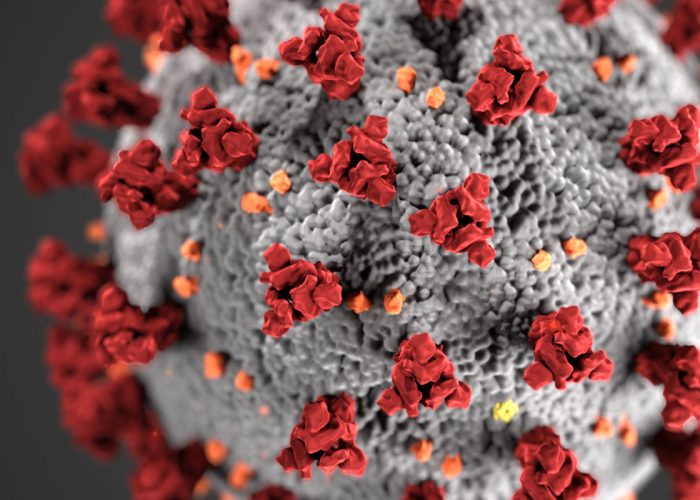

Africa faces a US$44 billion debt servicing bill this year, while the respiratory disease caused by the new coronavirus (COVID-19) could potentially infect between 29 and 44 million people in Africa, which potentially threatens already weak healthcare infrasctructure in the region.

Faced with mounting pressure to strengthen healthcare systems and social safety nets, African nations require access to capital, and while debt relief may seem tempting, the complexity of negotiations with private creditors as well as the potential impact on ratings and access to capital markets means that many African countries have preferred to focus on official sector relief, at least initially.

The AfricaPCWG supports this approach and is opting to deal with countries on an individual basis with a long-term view of protecting their access to capital, which will be critical in the months to come.