In 2010, ATI provided a $144 million boost to Uganda’s insurance capacity

KAMPALA, UGANDA, 7 December 2010 – Since opening a local office in 2009, the African Trade Insurance Agency (ATI) has left its mark on Uganda’s insurance market with an increase in the industry’s capacity. Through additional capital, backed by ATI’s partners in the Lloyd’s of London insurance market, local insurers are now able to extend coverage that protects businesses and property against damage from political violence, terrorism and sabotage.

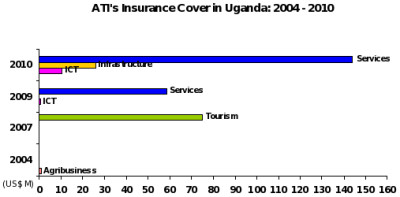

As a founding member, Uganda has benefited from ATI’s unique brand of insurance products – since 2004, ATI has supported over $316 million worth of Uganda’s exports and investments. This support includes insurance to projects in the tourism industry valued at over $75 million, improvements to local infrastructure worth $26 million, expansion of the telecommunications sector worth $11 million and increased insurance capacity totaling over $200 million.

“Our message is quite simple. ATI’s purpose in Uganda is to help insurers provide more options to their policy holders on one hand, while also supporting Ugandan exporters in this difficult global economic climate,” notes Allan Mafabi, a veteran of the Ugandan insurance market.

In Uganda, the benefits, particularly during the current economic climate, can be enormous. Some of the common business issues that this insurance can help alleviate include:

- Local investors and businesses seeking financing for their projects but are unable to negotiate favourable terms with their local or foreign banks as a result of credit risks

- Local banks are forced to limit lending because of third party risks – the credit risks of their clients’ buyers in the case of exporters

- Local importers are told to pay up front because they are unable to negotiate credit terms with their foreign suppliers as a result of default risks

- Local exporters suffering from non-payment and other risks as their clients in Europe and elsewhere default on payments

ATI offers two unique insurance products – political risk insurance also known as investment insurance, and trade credit insurance. Together these products have helped increase the competitiveness of African exporters as well as attracting foreign direct investments over the last decade.

Trade credit insurance is a product that exporters in Europe and North America have been using to great benefit for decades. Exporters from these markets are insured by their national export credit agencies against risks such as non-payment, enabling them to do business anywhere in the world. This makes them more competitive than African exporters, who often trade on cash against documents or Letters of Credit terms of payment. ATI is Africa’s export credit agency, offering many of the same services that could help increase Africa’s competitiveness.

In this chart, the services category represents increased insurance capacity provided to insurers or individual companies to protect against political violence, terrorism & sabotage related acts.

Specifically, political risk insurance, is insurance that investors, whether they be African or foreign investors, can obtain to protect their business interests against government actions or politically-motivated violence that may impact negatively on their business. This provides protection for investors and lenders interested in bringing their money to Uganda.

ATI’s unique advantage is that African countries such as Uganda have invested their money to become members of the Agency, therefore governments have no reason to cause any claims. Investors are reassured by this relationship and have chosen ATI’s political risk insurance over foreign-based companies, precisely because ATI is an African institution with a clear understanding of the challenges and opportunities inherent in the business environment here.

In a move to increase awareness and understanding of the benefits of investment and trade credit insurance products, ATI is hosting a series of seminars from 9 – 10 December at the Serena hotel aimed at insurance brokers, bankers and the media. The seminars will be led by Stewart Kinloch, ATI’s Chief Underwriting Officer and Allan Mafabi, ATI’s Uganda Representative.